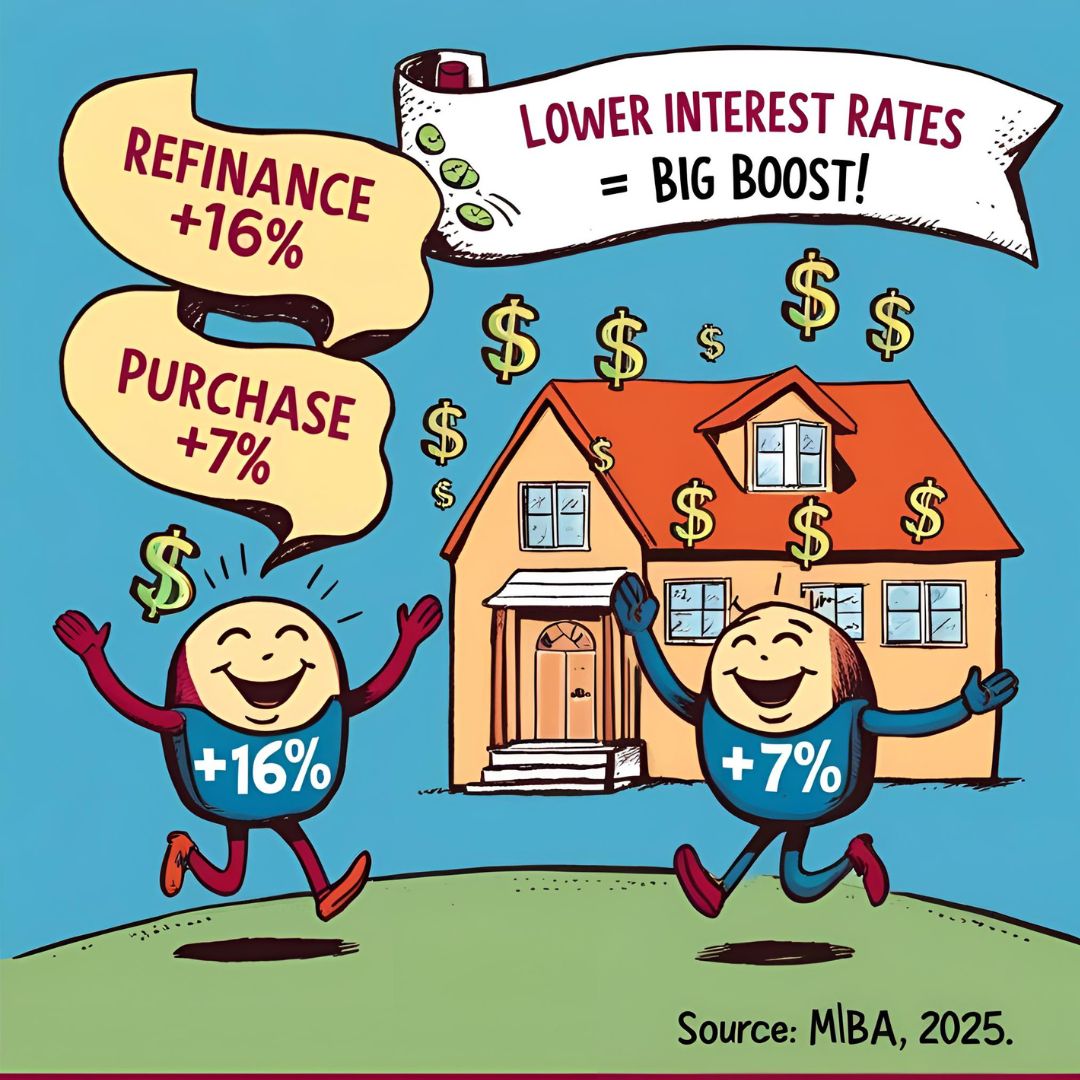

How Lower Interest Rates Boosted Refinances by 16% and Purchases by 7%, According to MBA

Mortgage applications have surged by 11.2% as interest rates continue to decline, marking a significant shift in the housing market. According to the Mortgage Bankers Association (MBA), refinance applications jumped by 16%, while purchase applications rose by 7%. This trend is a clear indicator of renewed activity in the mortgage sector, offering both challenges and opportunities for borrowers, lenders, and real estate professionals. Below, we’ll explore the reasons behind this increase, its importance for mortgage loans, and how to capitalize on the current market dynamics.

Why Mortgage Applications Are Rising

The recent rise in mortgage applications can be attributed to several key factors:

- Declining Interest Rates: Mortgage rates have fallen for the sixth consecutive week, with the average 30-year fixed rate dropping to 6.67%, the lowest since October 2024. This decline has made borrowing more affordable, encouraging both new buyers and those looking to refinance.

- Economic Stability: Improved economic conditions and a stable job market have boosted consumer confidence, leading to increased activity in the housing market.

- Seasonal Trends: The spring homebuying season typically sees a surge in activity, and 2025 is no exception. The purchase index is now 4% higher than it was a year ago.

- Government-Backed Loans: FHA and VA loans have seen significant growth, with government purchase applications increasing by 11%. Lower FHA rates, now at 6.34%, have made these loans more accessible.

The Importance of This Trend for Mortgage Loans

The rise in mortgage applications has several implications for the mortgage industry:

- Increased Loan Volume: Lenders are experiencing higher demand, which can lead to increased revenue. The refinance share of mortgage activity has risen to 45.6%, up from 43.8% the previous week.

- Opportunities for Borrowers: Lower rates provide an excellent opportunity for borrowers to lock in favorable terms. The average loan size for purchase applications has reached $460,800, the highest in the survey’s history.

- Market Momentum: The uptick in applications signals a robust housing market, which is beneficial for the broader economy. Real estate transactions contribute significantly to local and national economic activity.

Why Now Is the Time to Refinance, Lend, and Sell: Seize the Market Momentum

For borrowers, lenders, and real estate professionals, the current market conditions offer unique opportunities:

For Borrowers:

- Refinance Now: With refinance applications up by 16%, now is an ideal time to lower your monthly payments or shorten your loan term.

- Explore Government-Backed Loans: FHA and VA loans offer competitive rates and lower down payment requirements, making them an attractive option.

- Act Quickly: As rates may not stay low indefinitely, it’s crucial to act promptly to secure favorable terms.

For Lenders:

- Streamline Processes: With increased demand, optimizing loan processing times can enhance customer satisfaction and operational efficiency.

- Target Marketing: Focus on promoting refinance options and government-backed loans to attract a broader customer base.

Challenges and Considerations

While the current market presents numerous opportunities, it’s essential to be mindful of potential challenges:

- Inventory Shortages: Limited housing inventory can make it difficult for buyers to find suitable properties.

- Rate Volatility: Although rates are currently low, they can fluctuate based on economic conditions and Federal Reserve policies.

- Affordability Issues: Rising home prices may offset the benefits of lower rates for some buyers.

Conclusion

The 11.2% rise in mortgage applications, driven by falling rates and increased refinance and purchase activity, is a significant development in the housing market. For borrowers, it’s an opportunity to secure favorable terms and achieve homeownership or financial savings. For lenders and real estate professionals, it’s a chance to capitalize on increased demand and drive business growth. By understanding the factors behind this trend and taking proactive steps, all stakeholders can benefit from the current market dynamics.

Read More

Leave Your Information Now!

Want personalized assistance? Visit our 'Contact Us' tab and leave your information with one of our experts.

Location

United States

Contact Info

- 14750 NW 77th Ct Suite 204, Miami Lakes, FL 33016

- 3150 SW 145th Ave, Miramar, FL 33027

- (786) 505-5105

- Fax: (754) 225-1011

- Team@LamasLoans.com

We do not share data with third parties for marketing/promotional purposes.

By submitting your phone number to Lamas Loans, you are authorizing a representative of our company to send you text messages and notifications. Message frequency may vary. Message/data rates apply. Reply STOP to unsubscribe to a message sent from us, and HELP to receive help.

Copyright © 2024 LAMAS LOANS | NMLS # 1517696 | An Equal Housing Lender