What is a Fixed Rate Mortgage?

A fixed-rate mortgage is a type of home loan where the interest rate remains constant throughout the entire term of the loan. This predictability makes it a popular choice for homebuyers who prefer stability in their monthly payments and want to avoid the fluctuations that come with adjustable-rate mortgages (ARMs). Let’s dive into the details of fixed-rate mortgages, exploring their benefits, drawbacks, and how they compare to other loan types.

Understanding Fixed-Rate Mortgages

A fixed-rate mortgage is structured so that the borrower pays a set interest rate and monthly principal and interest payment for the duration of the loan. This loan type is commonly available in terms of 10, 15, 20, or 30 years, with 30-year fixed mortgages being the most popular due to their lower monthly payments.

Lenders determine the interest rate at the beginning of the loan based on market conditions, creditworthiness, and other factors. Once locked in, this rate does not change, regardless of inflation or economic shifts. This stability allows borrowers to plan their finances without worrying about unexpected increases in mortgage costs.

Advantages of Fixed-Rate Mortgages

Fixed-rate mortgages offer several benefits that make them attractive to homebuyers:

Predictable Monthly Payments: Since the interest rate is constant, homeowners can budget more effectively without worrying about sudden increases in their mortgage payments.

Simplifies Financial Planning: Long-term financial planning becomes more manageable because borrowers know exactly how much they will pay each month for the duration of the loan.

- Ideal for Long-Term Homeownership: If the borrower plans to stay in their home for many years, a fixed-rate mortgage provides stability and peace of mind.

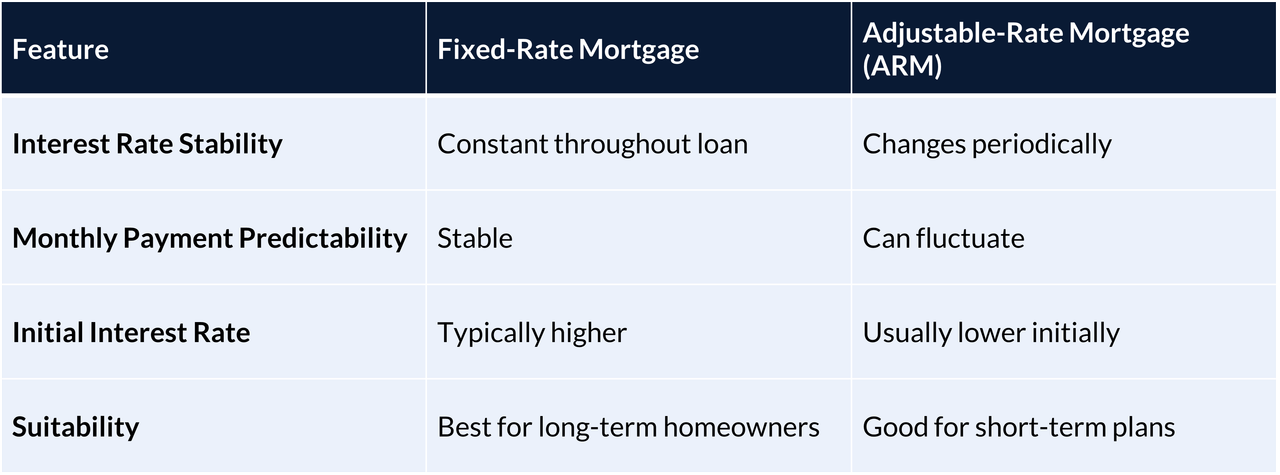

Comparing Fixed-Rate and Adjustable-Rate Mortgages

The main alternative to a fixed-rate mortgage is an adjustable-rate mortgage (ARM), which features a variable interest rate that can change periodically based on market conditions. Here are some key comparisons:

Is a Fixed-Rate Mortgage Right for You?

Choosing a fixed-rate mortgage depends on several factors:

Long-Term Stability Needs: If you prefer consistent payments and plan to stay in your home for a long time, a fixed-rate mortgage is an excellent choice.

Interest Rate Considerations: When market rates are low, locking in a fixed rate can be beneficial, protecting you from future rate hikes.

Financial Situation: If you can handle slightly higher initial payments in exchange for long-term security, a fixed-rate mortgage is likely the best option.

Final Thoughts

Fixed-rate mortgages provide financial stability, making them one of the most popular choices among homebuyers. While they may come with slightly higher initial interest rates, the long-term predictability and protection against market volatility make them a reliable option for those looking to plan their finances with confidence.

Discover the best loan options

Secure your financial future today!

FHA

An FHA loan is a government-backed mortgage offering low down payments and flexible terms for homebuyers.

VA

A VA loan is a benefit for veterans, offering zero down payment and flexible terms, backed by the U.S. government.

Rehab

A Rehab loan finances home renovations, combining purchase or refinance costs with renovation expenses.

Leave Your Information Now!

Want personalized assistance? Visit our 'Contact Us' tab and leave your information with one of our experts.

Location

United States

Contact Info

- 14750 NW 77th Ct Suite 204, Miami Lakes, FL 33016

- 3150 SW 145th Ave, Miramar, FL 33027

- (786) 505-5105

- Fax: (754) 225-1011

- Team@LamasLoans.com

We do not share data with third parties for marketing/promotional purposes.

By submitting your phone number to Lamas Loans, you are authorizing a representative of our company to send you text messages and notifications. Message frequency may vary. Message/data rates apply. Reply STOP to unsubscribe to a message sent from us, and HELP to receive help.

Copyright © 2024 LAMAS LOANS | NMLS # 1517696 | An Equal Housing Lender